How to Dispute Negative Items on a Credit Report That Are Not Correct

Finding negative items on a credit report that are not correct can be frustrating and harmful to your credit score. This article will help you identify these errors and guide you through the steps to dispute and remove them effectively.

Key Takeaways

- Identifying and disputing incorrect negative items on your credit report is crucial for maintaining and improving your credit score.

- Preparing a detailed dispute, including gathering supporting documents and writing a clear dispute letter, increases the chances of a favorable resolution with credit bureaus.

- Regular monitoring of your credit report and proactive measures against identity theft can help prevent future errors and ensure accurate credit history.

Identifying Incorrect Negative Items

Identifying inaccurate negative items on your credit report is a key step towards improving your credit score. Disputing unfairly reported items is advisable. Whether it’s an inaccurate payment history, wrong personal information, or closed accounts reported as open, these errors need to be addressed. Derogatory items, including late payments, usually stay on your credit report for a duration of seven years. This can impact your credit history significantly during that time. However, sometimes these negative items can be reported incorrectly, leading to them staying on your credit report beyond the normal duration.

Disputing errors helps remove negative information that does not accurately reflect your credit behavior. Generally, negative items stay on your report for around seven years, but some transactions might allow them to remain indefinitely based on financial thresholds.

Regularly reviewing your credit report helps catch these inaccuracies early.

Common Errors to Look For

While scrutinizing your credit report, look for common errors that can affect your credit score, such as identity theft, outdated information, and mixed files with someone else’s data. These errors can lead to wrong names, incomplete names, or entirely inaccurate personal information being associated with your credit history.

Disputing such errors is important as they can significantly impact your financial standing. Incorrect names or outdated information can confuse lenders and affect your ability to secure credit. Keeping your credit report accurate helps maintain a healthy credit score.

Reviewing Your Credit Report

Start by obtaining your free annual credit reports from Equifax, Experian, and TransUnion at AnnualCreditReport.com. Once you have your reports, examine the details closely.

Check for inaccuracies in your personal information, account details, and payment history. Regularly reviewing your credit reports helps catch errors early. Focus on your credit history, credit limits, bank statements, and any discrepancies in account statuses like closed accounts reported as open.

Thoroughly reviewing your credit reports helps identify and address inaccuracies that may impact your credit score.

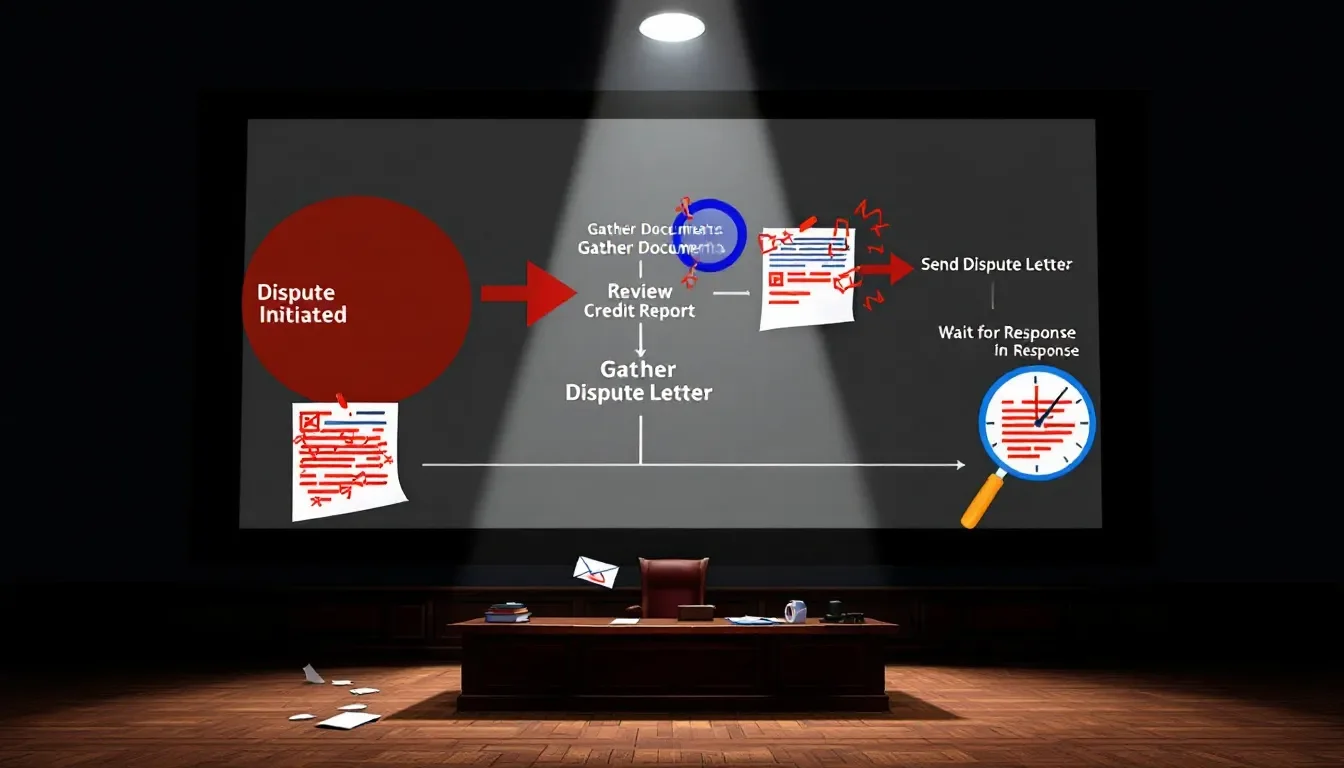

Preparing to Dispute Incorrect Information

Preparation is key before disputing inaccuracies on your credit report. Identify the specific inaccuracies and gather all relevant documentation to support your claim. Well-documented disputes are more likely to be resolved in your favor.

Gather all relevant documents, such as bank statements, payment receipts, and account verification emails, before starting a dispute. Properly organizing and presenting your evidence enhances the effectiveness of your dispute letter.

Gathering Supporting Documents

Collecting supporting documents is vital in the dispute process. Gather copies of relevant documents, such as bank statements and payment receipts, to substantiate your dispute. These documents provide concrete evidence to back up your claim of inaccurate information.

Clearly organizing and presenting your evidence is crucial. Include supporting documents such as account statements and payment records when sending a dispute letter to the credit bureau. Proper documentation strengthens your case and increases the likelihood of a favorable resolution.

Writing a Dispute Letter

A well-drafted dispute letter should clearly outline the error and include your contact information and a description of the disputed items. Include supporting documents and send the letter via certified mail for tracking.

Contact both the credit reporting agency and the source of the information when disputing errors. This ensures all parties involved are aware of the dispute and can investigate and correct the inaccuracies. Properly addressing your dispute letter can greatly influence the outcome.

How to Dispute Errors with Credit Bureaus

Disputing errors with credit bureaus ensures your credit report reflects accurate information. Send a written request to the credit bureau that generated the report with inaccuracies. Dispute inaccuracies with each credit bureau directly to ensure corrections are made.

You can dispute errors with credit bureaus online, by mail, or by phone. Each method has its own process and benefits, so choose the one that best suits your needs.

Disputing Online

Disputing errors online is quick and convenient. Equifax, Experian, and TransUnion offer online portals for submitting disputes, providing a streamlined process that can expedite resolution.

Online portals provided by major credit bureaus allow direct submission and tracking of disputes, making it a convenient and fast option for many consumers.

Disputing by Mail

Disputing errors by mail involves sending a detailed dispute letter to the credit bureau. Send your letter via certified mail to confirm its delivery and provide a tracking method.

Using certified mail with a return receipt when disputing by mail allows you to track the dispute and confirm receipt by the credit bureau, ensuring documentation and tracking throughout the process.

Disputing by Phone

Disputing errors by phone allows you to speak directly with a representative. Contact Equifax at 866-349-5191, Experian at 888-397-3742, and TransUnion at 800-916-8800.

What Happens After You Submit a Dispute

Once a dispute is filed, credit bureaus like Experian will investigate, possibly contacting the entity that reported the disputed information. They must complete the investigation within 30 to 45 days.

The credit bureau will reach out to the creditor for verification. Once the investigation concludes, the credit bureau must inform the consumer of the results and any modifications within five business days.

Investigation Timeline

Credit bureaus must investigate disputes within 30 days and respond to the consumer within five days of completing the investigation. Additional information provided by the consumer can extend the timeline to 45 days.

After the investigation, the credit bureau must inform the consumer of the results and any modifications within five business days. If a dispute is deemed frivolous, the bureau must notify the consumer and cease the investigation.

Possible Outcomes

The results of a dispute can include correction, deletion, or confirmation of the disputed data’s accuracy. After investigation, the outcomes may involve correcting the information, deleting it from the report, or confirming its accuracy.

Outcomes can include correcting inaccurate information or removing the disputed item from the credit report. Each outcome can significantly affect the consumer’s ability to secure loans, mortgages, and other financial products.

Monitoring Your Credit Report Post-Dispute

Tracking your credit report after a dispute confirms that corrections have been made. Regular monitoring helps identify discrepancies before they impact your credit score.

Regular checks on your credit reports help catch errors before they impact your score. Keeping a close eye on your report ensures any changes from a dispute are accurately reflected.

Checking for Updates

Check your credit report regularly, especially within 30 days following a dispute, to identify updates or changes. This confirms corrections and ensures your report’s accuracy.

Ensuring Dispute Notice is Present

A dispute notice on your credit report indicates an item is being contested. If a disputed item remains, a notice should indicate its disputed status.

This informs potential creditors of the disputed status, safeguarding your interests.

What to Do If Your Dispute Is Rejected

If a credit bureau rejects your dispute, contact the creditor directly to demand correction. File a new dispute with additional supporting information if necessary. Filing a complaint with the Consumer Financial Protection Bureau (CFPB) can escalate issues with credit reporting agencies.

Consult an attorney if considering a lawsuit against a credit reporting agency or creditor. Taking these steps ensures your dispute is taken seriously and addressed appropriately.

Escalating the Dispute

Contacting higher-level management at the creditor when escalating a dispute may yield better results, often resulting in a more favorable review.

If your dispute is dismissed, submit a complaint with the Consumer Financial Protection Bureau (CFPB). These escalation methods enhance your chances of correcting negative items on your credit report.

Seeking Legal Advice

Consulting a credit repair professional or attorney can be beneficial if persistent negative items affect your credit and traditional dispute methods fail. Credit repair professionals typically have in-depth knowledge of the Fair Credit Reporting Act (FCRA), Fair Debt Collection Practices Act (FDCPA), and credit reporting regulations.

They can efficiently spot opportunities to remove negative items from your credit report. Hiring a professional can save you time and potentially improve your credit score.

Preventing Future Errors

Preventing future errors on your credit report is as important as correcting existing ones. Regularly monitoring your credit report helps catch errors early and improves overall financial health. Implement security measures like strong passwords and two-factor authentication to protect against identity theft.

Consulting a legal expert may be essential for persistent issues with inaccurate information on your credit report. Hiring a legal professional helps navigate disputes and enforce your rights under the Fair Credit Reporting Act.

Regularly Reviewing Your Credit Reports

Regularly reviewing your credit report helps catch and correct errors early. Reviewing at least annually, or more frequently like quarterly, helps maintain awareness of any changes post-dispute.

Consistent review of credit reports can uncover inaccuracies that negatively impact your credit score. Proactive monitoring helps catch errors early and ensures your credit score reflects accurate information.

Protecting Against Identity Theft

Using strong, unique passwords for online accounts is crucial to prevent unauthorized access to your personal information. Implementing security measures such as strong passwords can help guard against unauthorized access to your personal information. Using strong, varied passwords can significantly reduce the risk of identity theft.

Shredding sensitive documents before disposal helps protect against identity theft. Securing your home and office records in a locked place is essential to prevent unauthorized access to personal data. These measures can safeguard your personal information and prevent identity theft.

Summary

Disputing incorrect negative items on your credit report is a critical step towards maintaining a healthy financial profile. By identifying inaccuracies, gathering supporting documents, and submitting well-prepared disputes, you can ensure your credit report accurately reflects your creditworthiness. Monitoring your credit report post-dispute and taking steps to prevent future errors are equally important for long-term financial health.

Remember, taking control of your credit report is not just about correcting past mistakes; it’s about proactively managing your financial future. Regularly reviewing your credit reports and protecting against identity theft can safeguard your credit score and open doors to better financial opportunities. Empower yourself with the knowledge and tools to keep your credit report clean and accurate.

Frequently Asked Questions

How often can I get a free credit report?

You can obtain a free credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion—once a year, totaling up to three reports annually. Access your free reports by visiting AnnualCreditReport.com.

What should I include in a dispute letter?

A dispute letter must include your contact information, a clear description of the error, any supporting documents, and should be sent via certified mail for tracking purposes. This ensures your dispute is organized and verifiable.

How long does the investigation process take?

The investigation process must be completed by credit bureaus within 30 days, with a response provided to the consumer within five days after the investigation concludes.

What are the possible outcomes of a dispute?

The possible outcomes of a dispute include correction, deletion, or confirmation of the accuracy of the disputed data. Each result serves to address the underlying issue effectively.

What should I do if my dispute is rejected?

If your dispute is rejected, you should contact the creditor to request a correction, consider filing a new dispute with additional supporting evidence, or seek legal advice to explore your options.