Struggling with overwhelming debt in Florida? Filing for Chapter 7 bankruptcy can give you a fresh financial start, but navigating the process alone is risky. I’m Michael Ziegler, a Chapter 7 bankruptcy attorney with over 15 years of experience helping Florida residents achieve debt relief. From understanding the means test to protecting your assets, I guide clients every step of the way.

Contact us today to schedule a free consultation and take the first step toward financial freedom.

Chapter 7 bankruptcy is often referred to as “liquidation bankruptcy.” It’s a process that allows individuals or businesses to discharge most of their debts, providing a fresh start. But what does that really mean, and how do you qualify?

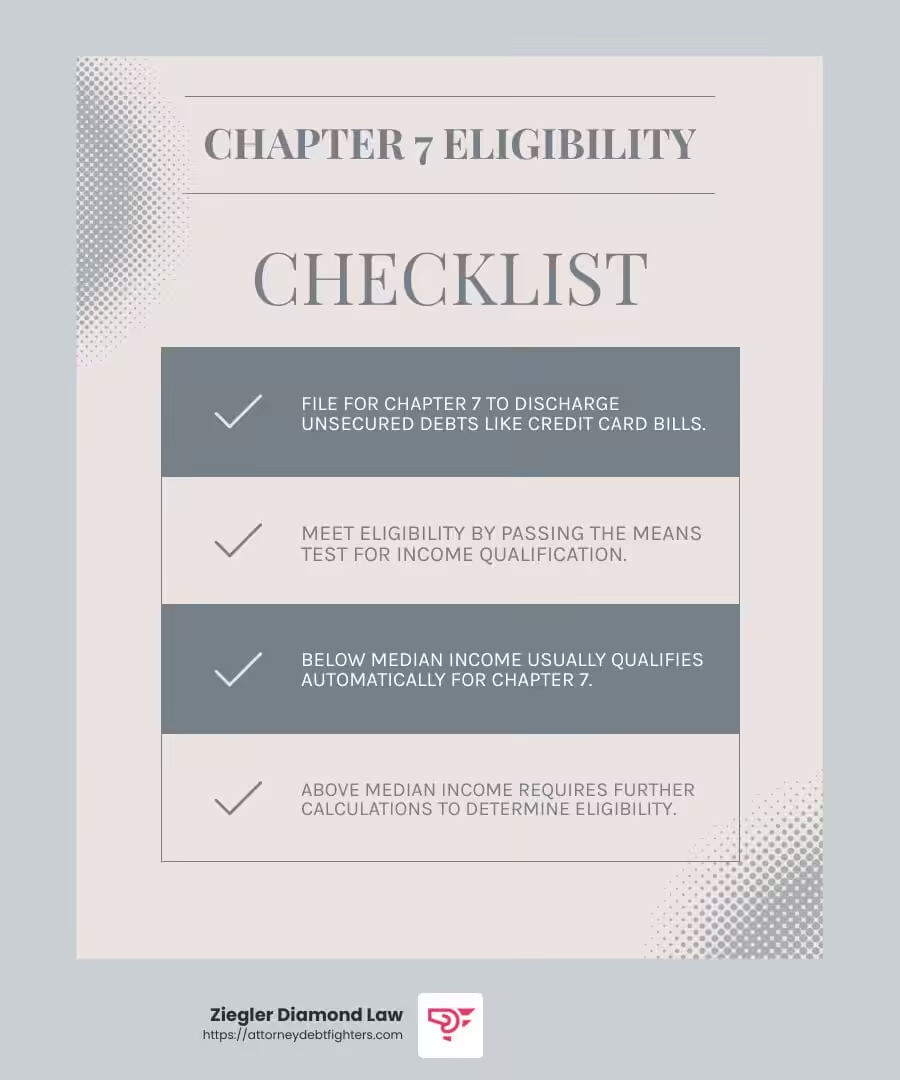

When you file for Chapter 7 bankruptcy, most of your unsecured debts can be discharged. This includes credit card debt, medical bills, and personal loans. Once these debts are discharged, you are no longer legally obligated to pay them. However, not all debts are dischargeable. For instance, obligations like alimony, child support, and certain tax debts typically cannot be wiped out.

To qualify for Chapter 7 bankruptcy, you need to pass the means test. This test determines if your income is low enough to make you eligible. The means test compares your average monthly income over the past six months to the median income for a household of your size in your state.

If you don’t qualify, Chapter 13 bankruptcy may be an alternative. A Florida bankruptcy attorney can help you determine your eligibility.

If you don’t qualify under the means test, you might need to consider Chapter 13 bankruptcy, which involves a repayment plan.

To calculate the means test, you’ll need to:

The means test can be complex, which is why many people seek the help of a chapter 7 bankruptcy attorney in Florida to ensure accuracy and improve their chances of qualifying.

Understanding these elements of Chapter 7 bankruptcy is vital before diving into the process. With the right information and legal guidance, Chapter 7 can provide a clear path to financial recovery.

When dealing with bankruptcy, understanding local laws and regulations is key. A local attorney will have in-depth knowledge of Florida’s specific bankruptcy laws and procedures. This expertise ensures that your case is handled efficiently and in compliance with all legal requirements.

Imagine you’re in Clearwater, FL. A local attorney familiar with the Clearwater court system can provide insights and guidance that a non-local attorney might miss. This local knowledge can significantly impact the outcome of your case.

Every bankruptcy case is unique, and a local attorney can offer personalized service custom to your situation. They can meet with you face-to-face to discuss your financial challenges and develop a strategy that best suits your needs.

A personalized approach means your attorney will take the time to understand your financial situation, helping you make informed decisions. This level of service is invaluable, especially when you’re already overwhelmed by debt.

Filing for Chapter 7 bankruptcy involves a lot of paperwork and court appearances. A skilled attorney will manage these tasks, ensuring everything is filed correctly and on time. They will represent you in court, making the process less stressful and more straightforward.

Legal representation is not just about handling paperwork. It’s about having a professional advocate who can negotiate with creditors on your behalf, ensuring your rights are protected throughout the bankruptcy process.

In summary, choosing a Chapter 7 bankruptcy attorney near you offers local expertise, personalized service, and robust legal representation. These elements are essential for navigating the complexities of bankruptcy and achieving a successful financial fresh start.

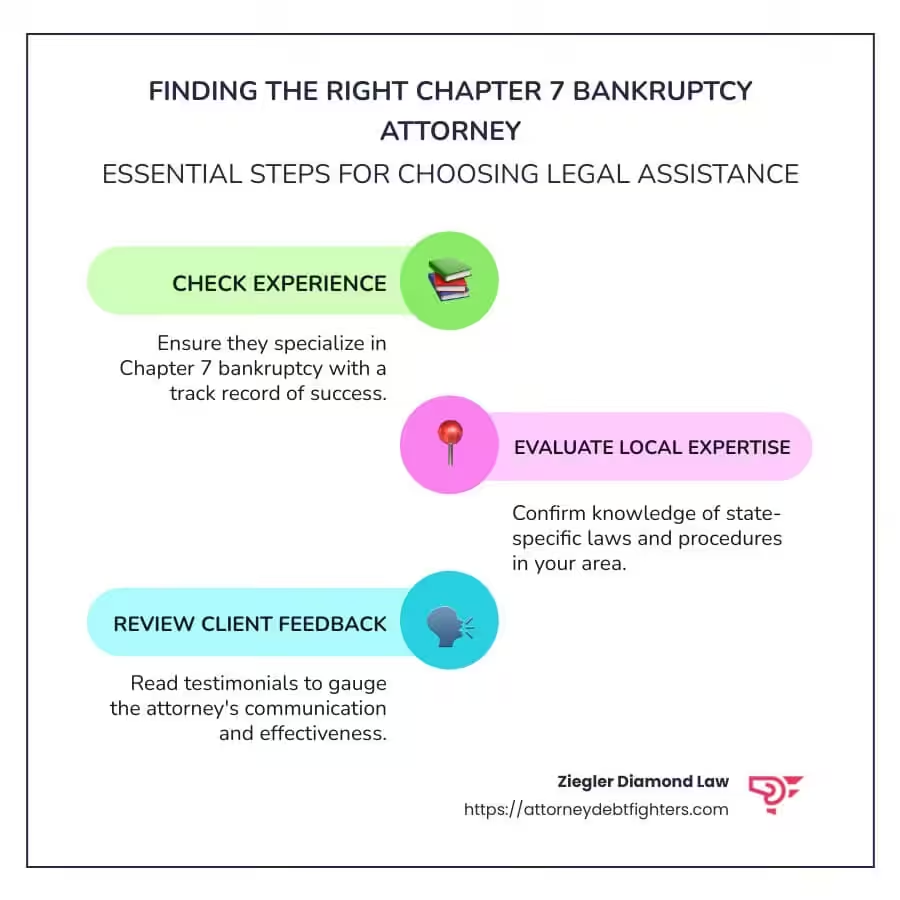

Choosing the right attorney is crucial when facing Chapter 7 bankruptcy. The right attorney will guide you through the process, ensuring everything runs smoothly. Here are some key factors to consider:

Experience matters. Look for an attorney with a proven track record in handling Chapter 7 bankruptcy cases. An experienced attorney will understand the nuances of bankruptcy law and have the skills to steer complex situations.

For instance, an attorney who has handled numerous cases in Pinellas County, FL, will be familiar with local court procedures and judges. This familiarity can make a significant difference in the efficiency and outcome of your case.

Client reviews offer valuable insights into an attorney’s reputation and the quality of their service. Read reviews from past clients to gauge their satisfaction levels and experiences. Positive reviews can indicate that the attorney is reliable, professional, and effective.

You might find comments like, “The attorney made the process stress-free and explained everything clearly,” which can reassure you about their ability to handle your case

The consultation process is your first interaction with a potential attorney. It should be a chance for you to ask questions, discuss your situation, and evaluate if the attorney is a good fit for you.

During the consultation, pay attention to how the attorney communicates. Are they clear and straightforward? Do they listen to your concerns? A good attorney will provide honest advice and outline the steps involved in the bankruptcy process.

Most attorneys offer a free initial consultation. Use this opportunity to assess their expertise and determine if they are the right choice for your needs.

By focusing on experience, client reviews, and the consultation process, you can find a Chapter 7 bankruptcy attorney near you who will guide you effectively through the bankruptcy journey.

Case Evaluation

A Chapter 7 bankruptcy attorney near you will start by evaluating your financial situation. They will assess your debts, assets, and income to determine if Chapter 7 is the best option for you. This evaluation is crucial because it sets the foundation for your entire bankruptcy case.

Think of it like a doctor diagnosing a patient. The attorney needs to understand all aspects of your financial health to recommend the right treatment.

Paperwork Management

Filing for Chapter 7 involves a mountain of paperwork. From the initial petition to various forms detailing your financial affairs, it’s easy to get lost. An attorney will handle all the documentation, ensuring everything is accurate and submitted on time.

This step is vital because any mistake can delay your case or even lead to dismissal. Attorneys know which forms you need and how to fill them out correctly.

Court Representation

Once your case is filed, it will go to court. While you may not have to appear before a judge, your attorney will represent you in all proceedings. They will communicate with the court and your creditors on your behalf, protecting your interests.

In the meeting of creditors—also known as a 341 meeting—your attorney will be by your side. This meeting allows creditors to ask questions about your finances. Having an attorney ensures that you are prepared and that your rights are protected.

In summary, a Chapter 7 bankruptcy attorney provides essential support through case evaluation, paperwork management, and court representation. They are your guide and advocate, helping you steer the complex bankruptcy process with confidence.

Chapter 7 bankruptcy, often called “liquidation bankruptcy,” allows individuals and businesses to discharge most unsecured debts. This means you can get rid of things like credit card debt and medical bills, giving you a fresh financial start. However, not all debts are dischargeable. For example, student loans and certain tax obligations usually stick around.

The process involves liquidating non-exempt assets. A court-appointed trustee sells these assets and uses the proceeds to pay creditors. But don’t worry—you won’t lose everything. There are exemptions that allow you to keep certain essential items.

The Chapter 7 process is relatively quick compared to other bankruptcy types. Typically, it takes about 90 to 120 days from filing to discharge. Here’s a simple breakdown of the timeline:

Filing the Petition: Once you file, an automatic stay is put in place. This stops creditors from collecting debts.

Meeting of Creditors: About 20 to 40 days after filing, you’ll attend a 341 meeting. Here, creditors can ask questions about your financial situation.

Discharge: If everything goes smoothly, you’ll receive a discharge of eligible debts 60 to 90 days after the creditors’ meeting.

Certain factors can delay the process, such as creditor objections or errors in paperwork. That’s why having a Chapter 7 bankruptcy attorney near you is beneficial—they can help avoid these pitfalls.

One of the biggest concerns for those considering Chapter 7 is asset retention. The good news is that exemptions allow you to keep essential items. These can include:

Part of the equity in your home and car

Clothing and personal items

Tools needed for your job

Social Security and other public benefits

Exemptions vary by state. In Florida, for example, you may have specific protections for your home and other assets. It’s crucial to understand these exemptions to know what you can keep.

If you’re worried about losing important assets, a local attorney can help. They will guide you through the exemptions and ensure your most vital possessions are protected.

Navigating the complexities of Chapter 7 can be challenging, but understanding these key aspects—debt liquidation, process timeline, and asset protection—can help ease the journey.

If you don’t meet the requirements for Chapter 7, Chapter 13 bankruptcy may be an alternative. Chapter 13 involves a structured repayment plan over 3–5 years while offering some debt relief. Your attorney can help determine which option best suits your situation.

Attorney fees vary depending on the complexity of your case and location in Florida. Most Chapter 7 cases have flat fees, making costs predictable. Many attorneys also offer free initial consultations to review your case and provide guidance before any fees are discussed.

Yes, filing Chapter 7 bankruptcy will impact your credit score, typically lowering it. However, it also allows you to eliminate unmanageable debt and start rebuilding your credit sooner. With proper guidance, you can take steps to recover your credit after discharge.

In most cases, you don’t need to appear in court beyond the 341 meeting of creditors, where your attorney can represent you and answer questions. This helps simplify the process and reduces stress for you.

An attorney provides crucial support by:

The easiest way is to schedule a free consultation. During this meeting, your attorney will review your financial situation, explain your options, and outline the steps to file for Chapter 7 safely and efficiently.

When it comes to Chapter 7 bankruptcy, having the right attorney can make all the difference in achieving a fresh financial start. Michael Ziegler brings over 15 years of specialized experience in handling Chapter 7 cases, guiding clients through even the most complex financial situations with confidence and expertise. He takes a personalized, client-focused approach, taking the time to understand your unique circumstances and develop a strategy tailored to your goals. With deep knowledge of Florida’s legal system, local courts, and bankruptcy procedures, Michael ensures your case is handled efficiently and in compliance with all state regulations. From preparing paperwork and managing deadlines to representing you at the 341 meeting of creditors, he provides comprehensive legal support while reducing stress and protecting your rights. Clients consistently praise his professionalism, responsiveness, and proven track record of successful outcomes, noting how he simplifies the process and helps them regain control of their finances. Don’t navigate Chapter 7 alone—contact Michael Ziegler today for a free consultation and take the first step toward debt relief and financial freedom.

When you file for bankruptcy Chapter 7, there are a couple of different variations that need to be highlighted. First, there’s a standard filing where all the documents are included and then a more limited filing that we sometimes call a “bare bones” petition or an emergency filing. In an emergency filing, just a very limited set of documents are filed to get a case number, but all the attachments aren’t there.

The other set of qualifiers are what we call an asset case or a no asset case. You see, in Chapter 7, and a lot of times people perceive, you file the paperwork and it’s all upside. The debts are just gone and there’s no other commitment. Unfortunately, that’s not really the full picture.

The exchange that happens in a Chapter 7 case is that the federal government gets rid of your debts, but the trade off is that if you have assets that exceed certain necessities that the government has identified, you may have to give up these excess assets as your commitment for the Chapter 7 relief. So for someone who doesn’t have assets that exceed the limitation set out by the government, we call that a no asset case. If someone has more than what they’re allowed to keep, then we call that an asset case.

Here we will map out what happens after you file Chapter 7 bankruptcy.

In Florida Chapter 7 bankruptcies, understanding the difference between an asset and a no-asset case is crucial. Not all debts just vanish – if you own assets beyond legal exemptions, those could be at risk. Whether filing a complete or emergency “bare bones” petition, it’s important to know the rules to avoid surprises and secure the best outcome.

The moment a petition is filed, it creates what we call an automatic stay or a legal freeze on all pending collection activity. Shortly after filing a Chapter 7 bankruptcy, notices will go to all of your creditors and you’ll receive a notice as well.

Your notice is going to go over some important highlights about the case:

During the bankruptcy process, the filer’s liability on all debts is eliminated. However, if there are some debts (usually secured debts like a car loan or maybe a mortgage), then the filer will have to communicate or interface with that creditor to reach an agreement to reestablish the debt. It is important to note that with secured loans, even though Chapter 7 bankruptcy will get rid of the personal liability, it does not get rid of what we call the security interest, meaning the ability of the lien holder to recover on that piece of property.

In the time between when you file Chapter 7 petition and your 341 meeting, there are a few steps that take place. So first, if you did file an emergency petition, you have a limited amount of time to file the remaining documents that go into your case. Those documents are generally called schedules and statements. The information that comes from those documents will provide transparency as to your household income, your expenses, and the things that you have.

Also leading up to the 341 meeting, you have to provide financial documents to the trustee. Generally, these are going to be things like tax returns, proof of income, and bank statements. If you have an attorney, they’re usually going to provide those documents to the trustee for you.

As previously stated, the 341 meeting is a meeting with the trustee. The trustee is going to go through some questions that they have about you and your financial circumstances so they can verify that you qualify for a Chapter 7 case. These questions also are used to evaluate whether you have assets that exceed the limitations that we mentioned before. Again, creditors also have an opportunity to ask a few questions.

Around the time that the 341 meeting takes place, there’s a few other steps that don’t necessarily have to go in a specific order, but do have to occur around that time. So first of all, if you do have an asset case, arrangements have to be made with the trustee to either turn over the assets or pay the trustee to offset the assets that you’d otherwise have to give up. You’ll also either directly, or with the aid of an attorney, want to make arrangements with any creditors for debts that you want to hold on to. Usually, those are going to be car loans or mortgages where you want to hold on to a particular asset. We call that arrangement a reaffirmation agreement.

Finally, you’ll want to take the second credit counseling class or the credit management class that’s required to be taken after filing a Chapter 7 bankruptcy. After the 341 meeting takes place, it’s generally around two to three months before the discharge order is entered, which is the order that wipes out the debts. Now for no asset case, usually at the same time that the discharge order is entered, a case closing order will also be entered and that will be the conclusion of the case.

For asset cases, the case will remain open because the trustee is required to go through a procedure to liquidate the assets, to disperse the assets to the appropriate creditors, and to provide certain disclosures for those different procedures. The timeline for a case closing in an asset case can vary, but usually lasts around 6 to 12 months after the 341 meeting. If you have any other questions about your particular circumstances, and if you’re based in Florida, please feel welcome to either click on our website or to a schedule consultation directly through Calendly. We don’t charge anything for a 30-minute consultation.

Are you a Florida resident that has questions about your prospective bankruptcy? Are you questioning whether bankruptcy is even the right option for you?

Our goal is to take a strategic approach to debt problem solving. What makes us different is that we aren’t just bankruptcy attorneys, but we look holistically at bankruptcy, debt consolidation, debt litigation and other alternatives.

Click on the Calendly link below to schedule a complimentary 30-minute consultation and let’s see if we can develop a strategy that’s in your best.